Comprehensive Payback Period Calculator Quickly Determine Your ROI

The payback period is the length of time it takes for a new feature or product to generate the amount of money it costs to develop the new product or feature. The payback period is favored when a company is under liquidity constraints because it can show how long it should take to recover the money laid out for the project. If short-term cash flows are a concern, a short payback period may be more attractive than a longer-term investment that has a higher NPV. Getting repaid or recovering the initial cost of a project or investment should be achieved as quickly as it allows. However, not all projects and investments have the same time horizon, so the shortest possible payback period needs to be nested within the larger context of that time horizon.

The Discounted Payback Period (DPP) Formula and a Sample Calculation

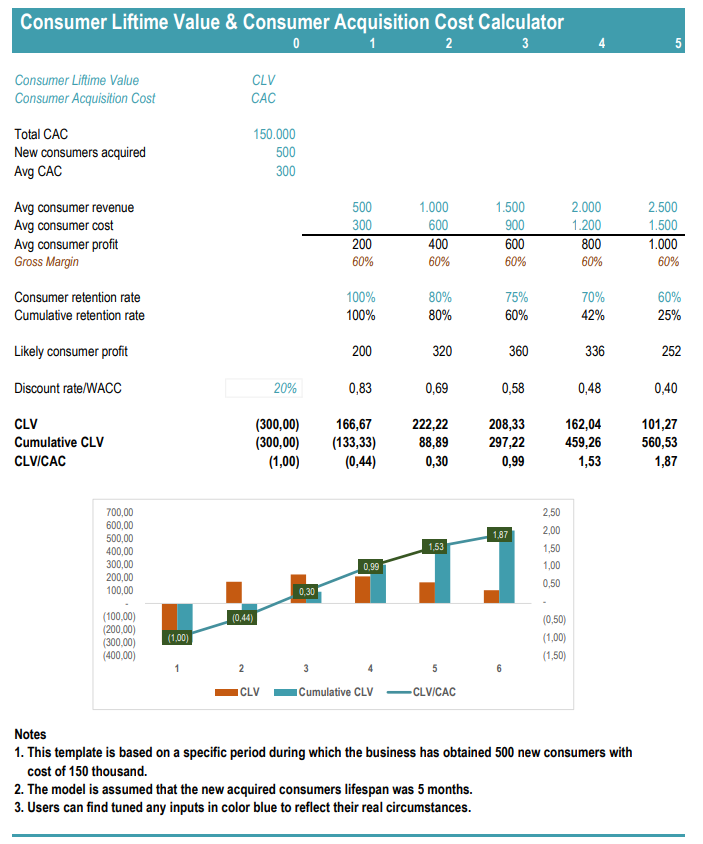

Discounted cash flow (DCF) is a valuation technique frequently used to evaluate investment possibilities utilizing the idea of the time value of money. Future cash flows are forecasted and discounted backward in time to arrive at a present value estimate, which is then assessed to see whether the investment what happens if you don’t file your taxes is justified. The discount rate used to calculate the present value of future cash flows in DCF analysis is the weighted average cost of capital (WACC). WACC is a method of calculating a company’s cost of capital in which each kind of capital, such as stock or bonds, is weighted proportionally.

Glossary of Terms Related to Payback Period

The payback period refers to how long it takes to reach that breakeven. For example, if solar panels cost $5,000 to install and the savings are $100 each month, it would take 4.2 years to reach the payback period. The payback period is a method commonly used by investors, financial professionals, and corporations to calculate investment returns. The payback period is the amount of time it takes to recover the cost of an investment.

- If you can add the estimated timeframe a feature will take to complete, you can start to prioritize features that may generate more revenue more quickly, allowing for faster growth.

- She has worked in multiple cities covering breaking news, politics, education, and more.

- The NPV is the difference between the present value of cash coming in and the current value of cash going out over a period of time.

- So, if a business invested $5,000 in a specific investment, the payback period will represent the exact amount of time before that investment has generated $5,000.

- For the calculations for cash inflows and cash outflows averaging method and subtraction method is used respectively.

Useful Tables: Comparing Payback Periods

You might one to know how many years you need for this investment to pay back. This calculation can be further complicated by the irregular cash flows that you receive. The basic payback period does not account for the time value of money, which is a limitation. However, the discounted payback period, a variation, incorporates discount rates to provide a more comprehensive analysis. Understanding the payback period is a crucial part of financial education. It introduces students to fundamental investment analysis concepts and teaches them to assess the risk and reward of different investment opportunities.

The investing platform lets you research and track your favorite stocks and ETFs. You can easily buy and sell with just a few clicks on your phone, and view your portfolio on one simple dashboard. Free loan, mortgage, cash value, math, algebra, trigonometry, fractions, physics, statistical information, time & date, and conversion calculators are provided here.

This is the idea that money is worth more today than the same amount in the future because of the earning potential of the present money. Although calculating the payback period is useful in financial and capital budgeting, this metric has applications in other industries. It can be used by homeowners and businesses to calculate the return on energy-efficient technologies such as solar panels and insulation, including maintenance and upgrades. You can use the payback period in your own life when making large purchase decisions and consider their opportunity cost. Knowing the payback period is helpful if there’s a risk of a project ending in the future.

In essence, the shorter the payback an investment has, the more attractive it becomes. Determining the payback period is useful for anyone and can be done by dividing the initial investment by the average cash flows. Any particular project or investment can have a short or long payback period. How investors understand that period will depend on their time horizon.

To counter these limitations, cross-reference results with other financial tools or consult a professional to validate assumptions. Now let’s dive into the different categories/types/range/levels of Payback Period calculations and results interpretation. Depending on the nature of the investment, there will usually be a considerable amount of time that passes before the business is able to reach its breakeven point. Andrew holds a Bachelor’s degree in Finance and a Bachelor’s degree in Political Science from the University of Colorado and specializes in finance, real estate, and life insurance.

This is another reason that a shorter payback period makes for a more attractive investment. Once you have entered all the numbers as stated above, click on “Calculate” button. This means that your investment will take approximately 3.875 years to get your initial investment of $ 2,500 back. Additionally, if you click on the fixed CF tab, you need to only define one cash flow assuming that this cash flow will be fixed. You can also increase the cash flow by a fixed percentage over the years if like so.

Simply, consider this free payback period calculator helps to get the estimated values of the payback period for regular and irregular cash flow. Before taking any decision with this payback calculator, consult with your finance manager. According to the basic definition, the time period from present to when an investment will be completely paid referred to as the payback time period. This analysis helps the investors to compare investment chances and decide which project has the shortest payback period. If investors going to invest in some projects, then they must know about the payback period.